Wednesday, May 25, 2016

Monday, May 23, 2016

Jesse Livermore - La leyenda de Wall Street

Aunque siempre nombramos a Benjamin Graham oWarren Buffett cuando hablamos de los grandes genios de la inversión, Jesse Livermore probablemente fuera el mejor trader o especulador de toda la historia. Jesse Livermore nació en 1877 y se suicidó en 1940 con más de 5 millones de dólares en activos líquidos, lo cual era una de las mayores fortunas personales de Wall Street en aquella época. Según dicen se quitó la vida a trastornos depresivo bipolar.

¿Dónde radica lo importante de la leyenda de inversión?.

Livermore se fue de casa a los 14 años con 5 dólares en su bolsa que su madre se los dio, y con solo informacion leida en los periodicos el se auto educo en inversiones y llegó a ganar 1.000 dólares a los 15 años de edad (muchísimo dinero en el año 1902). Fue un inversor hecho a sí mismo el cual hizo una gran fortuna multimillonaria y la perdió en diferentes ocasiones hasta alcanzar lo que acabó considerándose como el método perfecto de inversión (al menos cuando acertaba).

Su nombre comenzó a sonar a los 18 años, cuando comenzó a apostar contra las denominadas Bucket Shop, que eran "Cuartitos financieros" que ejercían como casas de bolsa usando algunas prácticas poco éticas y fraudulentas. Livermore ganó tanto dinero con este tipo de operaciones que se le prohibió este tipo de inversión en prácticamente todo Boston, por lo que a los 20 años se trasladó a Nueva York, donde saltó a la fama en Wall Street tras el derrumbe bursátil de 1907, apostando en corto contra los mercados y generando una ganancia de 3 millones de dólares.

Como especulador, Jesse Livermore se ganó toda una reputación cuando en 1907 y de nueva cuenta en 1929, dirigió sus apuestas en contra de la alza de los mercados. Cuando la caída de los precios cesó, su fortuna personal rondaba los 100 millones de dólares, una extraordinaria ganancia que hoy equivaldría a 1.2 billones de dólares

Aunque siempre nombramos a Benjamin Graham oWarren Buffett cuando hablamos de los grandes genios de la inversión, Jesse Livermore probablemente fuera el mejor trader o especulador de toda la historia. Jesse Livermore nació en 1877 y se suicidó en 1940 con más de 5 millones de dólares en activos líquidos, lo cual era una de las mayores fortunas personales de Wall Street en aquella época. Según dicen se quitó la vida a trastornos depresivo bipolar.

¿Dónde radica lo importante de la leyenda de inversión?.

Livermore se fue de casa a los 14 años con 5 dólares en su bolsa que su madre se los dio, y con solo informacion leida en los periodicos el se auto educo en inversiones y llegó a ganar 1.000 dólares a los 15 años de edad (muchísimo dinero en el año 1902). Fue un inversor hecho a sí mismo el cual hizo una gran fortuna multimillonaria y la perdió en diferentes ocasiones hasta alcanzar lo que acabó considerándose como el método perfecto de inversión (al menos cuando acertaba).

Su nombre comenzó a sonar a los 18 años, cuando comenzó a apostar contra las denominadas Bucket Shop, que eran "Cuartitos financieros" que ejercían como casas de bolsa usando algunas prácticas poco éticas y fraudulentas. Livermore ganó tanto dinero con este tipo de operaciones que se le prohibió este tipo de inversión en prácticamente todo Boston, por lo que a los 20 años se trasladó a Nueva York, donde saltó a la fama en Wall Street tras el derrumbe bursátil de 1907, apostando en corto contra los mercados y generando una ganancia de 3 millones de dólares.

Como especulador, Jesse Livermore se ganó toda una reputación cuando en 1907 y de nueva cuenta en 1929, dirigió sus apuestas en contra de la alza de los mercados. Cuando la caída de los precios cesó, su fortuna personal rondaba los 100 millones de dólares, una extraordinaria ganancia que hoy equivaldría a 1.2 billones de dólares

Livermore muchas veces no siguió sus propias reglas y el señalaba que esta falta de adherencia a sus propias reglas era la principal razón por la cuál había perdido sus más grandes fortunas.

El libro de Reminisencias de un operador de bolsa escrito por Edwin Lefevre se piensa que fué escrito a manera de su biografía y comunmente es confundido con una autobiografía de Livermore, esto tiene su fundamento en que en este libro aparecen muchas de sus lecciones de trade personales. Sin embargo, se piensa que Lefevre, que era periodista, era utilizado más bién por Livermore y otros para obtener información y publicar notas "implantadas" con el fin de mover a los mercados.

Livermor personalmente escribió un libro menos conocido llamado "Cómo operar acciones" publicado en 1940, el mismo año en el que cometió suicidio. El libro obtuvo criticas ambiguas por los "gurus de entonces" y sus ventas no llegaron a ser brillantes.

Livermore se casó 3 veces, la primera en 1900 a la edad de 23 años, pero al primer año de casados Livermore perdió toda su fortuna y le pidió a su esposa (Nettie Jordan) que empeñara sus joyas que le había regalado para tener nuevo capital para especular, a lo que esta se negó rotundamente, dañando la relación entre ellos definitivamente, en 1917 se divorcia de ella..

Livermore siguió haciendo fortuna en los mercados alcistas de la década de los años 1920. En 1929 detectó condiciones similares a las de 1907 y comenzó a estar corto en multiples acciones y posteriormente piramidó una vez estas posiciones. Cuando prácticamente todos en el mercado habían perdido todo su dinero, Livermore ya habría ganado unos 100 millones.

A los 41 años se casó con una chica de 18 años, la que sería su 2da esposa, en medio de prosperidad contando entre sus benes con mansiones al rededor del mundo, flotas de limusinas y un yate para viajes personales a Europa. Con esta chica su matrimonio dió además a 2 hijos Jesse Jr. y Paul. Dorthea Wendt (quien había sido corista) en 1932, lo deja para posteriormente casarse con su nuevo amante, un señor llamado Walter Longcope) sin embargo la demanda de divorcio interpuesta por "Dorothy" fundamentaba abandono.

Menos de un año después Livermore se casa con Harriet Metz de 38 años de edad y (aquí lo escalofriante) viuda de 4 maridos suicidas. Livermore no sería la excepción, luego de 7 años de matrimonio Livermore sería el quinto suicida que convirtiera una vez más a Harriet en viuda.

En 1934 Livermore quiebra nuevamente (quemó su gran fortuna entera en 5 años) y es suspendido de la Chicago Board of Trade.

En 1938 su hijo le recomienda escribir un libro, el cuál es terminado en 1939 y publicado en 1940, pero después el 28 de Noviembre se pega un tiro y es encontrado muerto en el guardarropa del hotel de apartamentos Sherry Netherland en la 5ta Avenida. en Nueva York.

La policiá nunca reveló su diario que llevaba consigo al morir y donde habría dejado una nota suicida de 8 cuartillas. Sin embargo el portavoz de la policia citado en la publicación de 30 de Noviembre del New York Tribune, leyó la siguiente cita: " Mi querida Nina, no puedo evitrlo. Las cosas han ido mal para mi. Estoy cansado de luchar. No puedo soportarlo más. Esta es mi única salida. No merezco tu amor. Soy un fracaso. Estoy muy apenado pero esta es la única alternativa para mi. Con amor Laurie.

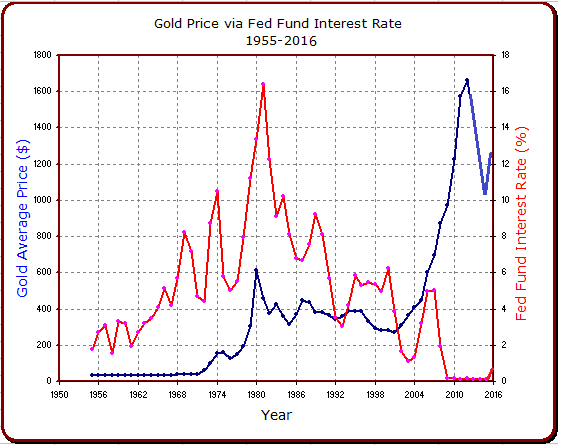

Gold via Fed Fund Interest Rate - A Historical Perspective

Gold prices

The gold price was set by the US government for a long period of time until recently. The official U.S. Government gold price changed only four times from 1792 to the present. Starting at $19.75 per troy ounce in 1792, raised to $20.67 in 1834, and $35 in 1934. In 1972, the price was raised to $38 and then to $42.22 in 1973. A two-tiered pricing system was created in 1968, and the market price for gold has been free to fluctuate since then.

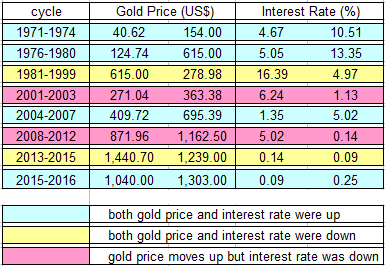

Let us take a closer look of the above chart:

Gold prices started really moving, either up or down, from 1971.

1971 - 1974: Gold prices moved up from $40.62 to $154.00. At the same time, the Fed Fund interest rate moved up from 4.67% to 10.51%.

1976 - 1981: Gold prices ran up from $124.74 to $615.00 while the Fed Fund interest rate skyrocketed from 5.05% to 13.35%.

1981 - 1999: This is the big down cycle for both gold prices and the Fed Fund interest rate. Gold prices dropped from $460 to $278 and the Fed Fund interest rate pulled back from 16.39% to 4.97%.

2001 - 2003: This is the period that gold prices moved up while interest rate pulled back further. Gold prices jumped from $271.04 to $363.38 while interest rates dropped from 3.88% to 1.13%.

2004 - 2007: The third time that both gold prices and interest rates moved up together. Gold prices ran up from $409.72 to $695.39 while interest rates increased from 1.35% to 5.02%.

2008-2012: This is the second time that gold prices and interest rates moved in opposite directions. While gold prices made a big move from $871.96 to $1,662.50, interest rates dropped from 1.92% to 0.14%.

2013 - 2015: This is the fourth time that both gold prices and interest rates dropped. While gold prices pulled back from $1,662.50 to $1,040.00, interest rates dropped from a then historical low of 0.14% to almost zero.

2015 - 2016: The Fed raised its Fund interest rate for the first time in nine years at the end of last December and gold prices responded. It gained more than 20% from 1,040 to 1,302 high in a few months.

The table below shows the correlations between the price of gold and the Fed Fund interest rate over the years:

That is, gold prices and interest rates are in positive correlation most of the time. When they move in opposite direction, it is gold up and interest rates down.

Data from over 60 years of history have never shown that an increased interest rate will result in lower gold prices.

Of course past performance can never be used to predict future performance. But it is my view that the 3 1/2 year gold price down-cycle has finally ended.

Other Forces Behind Gold Price Movement

- Whenever the market crashes or bad US economic news comes out, gold prices moves higher. This is because investors will sell stocks and buy into gold as a safe haven. But the opposite is not always true.

- A strong US dollar also tends to bring gold prices down. But this is not always true. It is particularly true that during the inflationary period, both the US dollar and gold prices will fly high as the dollar will be worth much less then.

- Market manipulation by big players including high frequency trading houses: in most times gold prices moved lower before Fed meetings and spiked high after no interest rate hike was announced. But a few weeks later, the gold price will always give up all the short term gains and set new lows.

Near Term Gold Direction

Gold has gone through two phases this year so far and is under phase three now.

Phase I: January 1 - March 10, uptrend run. Gold ran from 1,060 to 1,287, gained 21.40%. The reason behind the big and quick run:

- Fed Fund interest rate raise first time in nine years -- hint for possible inflation.

- Market crash -- due to the fear of US economic slowdown and poor corporate earnings. But market started its recovery since February 11 low, and gold kept running until March 10.

Phase II: March 10 - May 2, consolidation and break out. Gold price was in almost two months of consolidation and broke out of its March 10 high on heavy volume to set up a new year high of 1,302 on May 2.

The news which ignited the gold break out was that US Q1 GDP was revised down to annual growth of 0.5%.

Phase III: From May 2 to May 19, three weeks so far and may last longer, pull back. Normal profit taking and no one knows for sure how long and how deep the pull back will be. But I believe that the pull back will not bring the gold price down to below 1,230.

Saturday, May 21, 2016

The Life Cycle of Money

In the aftermath of the global economic crisis of 2008-2009, governments throughout the world have fostered a tenuous recovery predicated on massive increases in money supplies and debasement of currencies. Note however, that monetary debasement is not a recent phenomenon; it is simply the natural life cycle of money. There are six well-defined stages in the life cycle of money. This progression has occurred in every dominant civilization over the 5000 years of recorded human history:

The Life Cycle of Money

In the aftermath of the global economic crisis of 2008-2009, governments throughout the world have fostered a tenuous recovery predicated on massive increases in money supplies and debasement of currencies. Note however, that monetary debasement is not a recent phenomenon; it is simply the natural life cycle of money. There are six well-defined stages in the life cycle of money. This progression has occurred in every dominant civilization over the 5000 years of recorded human history:

Stage 1: A Barter Market Begins. Societies organize and begin to function with a basic barter system for trading goods. Incipient barter is a direct exchange of goods for goods. Goods are defined as wealth and wealth is produced when humans apply labor and knowledge to extract natural resources from the earth. As the civilization progresses, services become of value and are also bartered. A citizen produces and barters his goods and/or services; their perceived value to the community is equal to his individual and/or familial wealth.

Stage 2: Free Market Money Emerges. After a barter economy is well-established, a society progresses to the concept of free market money and a currency system emerges. Having a recognizable, reliable, and uniform unit of monetary exchange facilitates business, commerce, and trade within and between citizens, communities, and societies. For 5000 years the currencies of choice have been gold and sometimes silver. Many civilizations have selected these precious metals as money based on trial and error and often independently of each other. Aristotle proposed four critical attributes for money nearly 2500 years ago: He wrote that money must be durable, portable, divisible, and intrinsically valuable. Gold has been repeatedly determined to be the beststore of value because it does not tarnish or corrode; it is easily stored and convenient to transport great distances; it can be minted in small and uniform pieces; and it is scarce. Although not as ideally suited as gold, silver has often served as a primary monetary instrument for trade and exchange.

Stage 3: Government Regulates the Market. Communal order is required in a functional society and therefore, a government is formed. Sometime later, government becomes involved in regulation of the marketplace. Its size and power grow and it begins to control more and more aspects of business, commerce, and trade. Laws, rules, and regulations are instituted to regulate and control trade through tariffs, taxes, quotas, and penalties. Taxes are imposed as a means to limit the wealth of ordinary citizens, preserve the power of the rulers, and support the growing government agenda. The economic system is increasingly divorced from a free market and forced to operate in a regulatory regime where government controls the money supply.

Stage 3: Government Regulates the Market. Communal order is required in a functional society and therefore, a government is formed. Sometime later, government becomes involved in regulation of the marketplace. Its size and power grow and it begins to control more and more aspects of business, commerce, and trade. Laws, rules, and regulations are instituted to regulate and control trade through tariffs, taxes, quotas, and penalties. Taxes are imposed as a means to limit the wealth of ordinary citizens, preserve the power of the rulers, and support the growing government agenda. The economic system is increasingly divorced from a free market and forced to operate in a regulatory regime where government controls the money supply.

Stage 4: Government Monopolizes the Money. The government takes absolute control of the money supply and sets up a currency system to issue official coinage from a central mint. It controls the size, design, weight, and purity of the coinage. Later, the government issues paper promissory notes redeemable in coinage and decrees that these notes are money, i.e., a fiat currency exchangeable for goods or services. Backed by its own laws, the government institutes a monopoly of the monetary system and forbids local governments, banks, and citizens to compete by issuing public or private currencies.

Stage 5: Government Debases the Money. Government must increase taxes to sustain its continuing growth, and citizens protest the seizure of their hard-earned wealth thru onerous taxation. In order to fund its growing obligations and to lessen dissent from higher taxes, the government begins to debase the value of its money. Historically, governments have shaved off pieces of coins, issued smaller coins, or made coins with less gold and/or silver content. The next step occurs when the government removes all precious metals from its coinage. Eventually, it declares that its promissory notes are no longer redeemable in precious metals. At this point, there is no basis to the monetary system other than the government’s promise to pay. The issuance of currency without backing by precious metals allows the government to create “money” at will for its own purposes. The government creates more and more money and, because the currency in circulation increases while the availability of goods and services remains the same, prices increase. The increase in money supply is known as inflation and the consistently rising prices for goods and services are a by-product of that inflation. Inflation robs citizens of wealth and savings by decreasing the purchasing power of their money.

Stage 6: No Confidence and Collapse of the Money. Inflation, indebtedness, and government deficits increase and citizens realize that the fiat currency representing their lifelong labors, savings, and wealth is continually losing value. Poor money management by government results in a stagnant economy, rising prices, shortages of food and goods, and increasing public and personal debt. The ongoing devaluation of fiat currency leads to a lack of confidence by the citizens with resulting runs on banks and collapse of the banking system. Civil and political unrest accelerates. Ultimately, the government defaults on its promises to pay and economic and societal chaos ensues.

Re-Emergence of Free Market Money.

Citizens desire a return to a monetary system that is stable, secure, and non-inflationary. They realize that gold is a safe haven for preservation of wealth and is the only insurance policy against oppressive government and constant currency debasement. Demand for gold and silver rise. If collapse of the previous civilization was complete, new societies eventually emerge with barter economies followed by evolution to free market money.

Those citizens with financial acumen have accumulated precious metals as a key component of their overall assets and survive the economic collapse with significant wealth. They become the financial leaders of a new free market money system based on gold, the citizens as a whole prosper and flourish, and widespread wealth grows again.

Those citizens with financial acumen have accumulated precious metals as a key component of their overall assets and survive the economic collapse with significant wealth. They become the financial leaders of a new free market money system based on gold, the citizens as a whole prosper and flourish, and widespread wealth grows again.

Conclusions:

It literally pays to understand the history of money in societies, city-states, countries, and empires. By recognizing the six stages in the life cycle of money and the position of present-day governments within this cycle, citizens can make better informed monetary decisions. They can partition their assets to maximize wealth and mitigate the effects of currency debasement and the chaos of economic collapse.

It literally pays to understand the history of money in societies, city-states, countries, and empires. By recognizing the six stages in the life cycle of money and the position of present-day governments within this cycle, citizens can make better informed monetary decisions. They can partition their assets to maximize wealth and mitigate the effects of currency debasement and the chaos of economic collapse.

Governments have universally debased their currencies without the backing of gold for 45 years. Central banks in both the world’s developed and undeveloped countries have repeatedly failed or have been bailed out by their governments by the issuance of more and more fiat currency.

The net results are increasingly high leverage, negative interest rates, extraordinary indebtedness, currency devaluations, serial defaults, and economic collapse of countries throughout the world. Monetary crises, food and supply shortages, rioting and rebellion, civil wars, and overthrow of oppressive regimes have become commonplace.

We have now entered stage 6 of The Life Cycle of Money with widespread lack of confidence in an entire basket of increasingly worthless fiat currencies. The $64,000 question is when will the inevitable global economic collapse occur?

I will flatly tell you that no macroeconomist, maven, medium, self-appointed prophet, pundit, talking head, or wizard can or will predict the exact timing.

That said, savvy citizens currently have the opportunity to acquire physical gold at a +30% discount to its historic high. We can still protect our wealth from the unholy shenanigans of corrupt and unstable governments led by politicians and rulers whose only concern is to preserve their power over the ordinary masses.

For these reasons, I urge you to make physical gold an integral part of your wealth. And I strongly suggest you do this sooner than later. Folks, please recall The Golden Rule: He who owns the gold, makes the rules.

For these reasons, I urge you to make physical gold an integral part of your wealth. And I strongly suggest you do this sooner than later. Folks, please recall The Golden Rule: He who owns the gold, makes the rules.

Ciao for now, Mickey Fulp Mercenary Geologist

Subscribe to:

Comments (Atom)